Stylish Medicare Supplement( Medigap) Providers Of 2022

Stylish Medicare does n’t cover all of your health care charges when you turn 65. Medicare Part A covers 80 of inpatient care in hospitals and professed nursing installations, and Medicare Part B covers 80 of inpatient care and medically necessary inventories. For the 20 not covered by Medicare, you have the option to buy Medicare Supplement( Medigap) insurance from a private insurance company.

To determine the Stylish Medicare Supplement( Medigap) Providers Of 2022stylish Medicare Supplement providers, the Forbes Health editorial platoon anatomized data onU.S. insurance companies that offer civil plans by the number of countries in which they give content, the number of types of plans they offer, how they ranked in terms of their fiscal health by agencies likeA.M. Best and further. Read on to see which providers made our list.

• Humana

Humana Inc. is a for-profit American health insurance company based in Louisville, Kentucky. In 2021, the company ranked 41 on the Fortune 500 lies

• AARP by UnitedHealth care

AARP/UnitedHealthcare Medicare Advantage plans provide good coverage and have an average overall rating of 4.2 stars. The company stands out for cheap PPO plans that cost $15 per month on average.

• Blue Cross Blue Shield

Blue Cross Blue Shield Association is a federation of 35 separate United States health insurance companies that provide health insurance in the United States to more than 106 million people

• Mutual of Omaha

Mutual of Omaha is a Fortune 500 mutual insurance and financial services company based in Omaha, Nebraska.

• Cigna

Cigna is an American multinational managed healthcare and insurance company based in Bloomfield, Connecticut

• Methodology

methodology is the study of research methods. However, the term can also refer to the methods themselves or to the philosophical discussion of associated background assumptions. A method is a structured procedure for bringing about a certain goal

Medicare Supplement Eligibility

To be eligible for a Medigap plan, you must be enrolled in Original Medicare Part A and Part B, but not a Medicare Advantage plan. You must also be in one of the following orders

• Age 65 and aged

• Under 65 and entering disability benefits

• Under 65 and diagnosed with amyotrophic side sclerosis( ALS)

• Under 65 and diagnosed with end- stage renal complaint( ESRD)

Companies could delay content up to six months for apre-existing condition if you did n’t have creditable content( other health insurance) before enrolling in Medicare.

Your Medigap open registration period starts the first month you subscribe up for Medicare Part B insurance at age 65 or aged, indeed if you delayed registration because you had group health content. Medigap programs can not be canceled by the insurance company indeed if your health status changes as long as you pay yourpremiums.However, you may apply to buy or switch plans, If you ’re formerly enrolled in a Medigap plan.

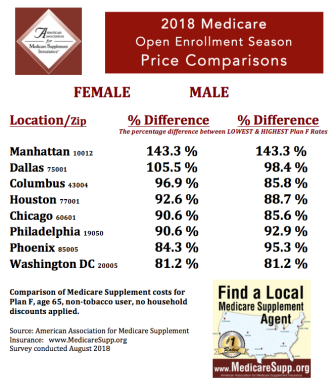

How important Does Medicare Supplement Cost?

“ Medicare supplements vary in rate by carrier and plan choice. Not every carrier offers all plans, ” says Brandy Corujo, mate of Cornerstone Insurance Group in Seattle. Policy prices for Medigap are set by the individual insurance companies dealing them. Companies set their decoration pricing in one of three ways

• Community- rated decorations are the same anyhow of age.

• Issue or entry age- rated decorations are cheaper if the policy is bought at a youngish age. decorations don’t increase with age.

• Attained- age- rated decorations are grounded on your age at the time of purchase. As you age, your decoration increases.

Some factors that may also impact your rates include your position, gender, connubial status and life( like if you bomb).

Medigap plans are bought through a private insurance company, and you pay a yearly decoration for the policy directly to the company. Medigap programs can be bought from any insurance company certified to vend one in your state, but available programs and prices will depend on your state. Medigap plans only cover one person, so wedded couples need to buy separate programs.

Medicare Supplement Plans F, G and N Which Is Stylish?

Medicare Supplement plans F, G and N are the most popular Medigap plans with the loftiest rates of registration nationwide. Which bone

is stylish depends on the devisee and their specific health care requirements.

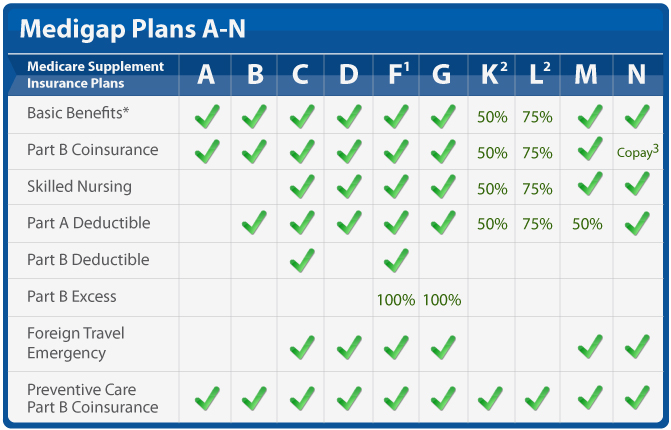

By and large, Plan F is the most popular Medicare Supplement plan due to its content of further out- of- fund Medicare costs than any other Medigap plan type. Plan F pays for Medicare deductibles, copays and other costs associated with Medicare- covered services, so heirs do n’t have to worry about out- of- fund charges. still, Plan F is no longer available to any Medicare devisee who came eligible for Medicare on or after January 1, 2020.

Due to these registration restrictions, Plan G is getting the most popular Medicare Supplement plan type for new Medicare enrollees, as it covers the utmost Medicare costs of any Medigap plan type that’s available to all heirs. Plan G heirs only have to pay their periodic Medicare Part B deductible, after which the plan provides 100 content on all Medicare- covered medical charges.

Incipiently, Plan N is the third most popular type of Medicare Supplement plan, which supports enrollees interested in a broad range of content. It provides 100 of Medicare Part B coinsurance costs, with the exception of$ 20 copays for office visits and$ 50 copays for exigency room( ER) visits. Heirs are responsible for the periodic Part B deductible as well. This structure keeps the cost of the plan fairly low despite risking advanced out- of- fund charges, which is why it’s generally preferred by those with smaller medical requirements.

What Are the Benefits of a Medicare Supplement Plan?

One of the primary benefits of Medicare Supplement plans is that they help alleviate the costs of health care not covered by Original Medicare, similar as copayments, coinsurance and deductibles. Any Medicare devisee who’s concerned about incurring potentially high out- of- fund costs should consider Medigap plans and how they can help cover these charges.

Some Medicare Supplement plans also give content for services that Original Medicare does n’t cover, similar as medical care demanded during trip outside theU.S. Medicare enrollees who enjoy frequent trip frequently enjoy the fresh subcaste of protection

.

Medicare Advantagevs. Medicare Supplement

Medicare Advantage plans serve as a cover for Original Medicare, furnishing that same content plus fresh benefits like tradition medicines content( Part D). Meanwhile, Medicare Supplement plans, or Medigap plans, are vended by private insurance companies to people enrolled in Original Medicare to help fill the gaps of that content.

The 10 types of Medigap plans give standardized content to heirs civil and help pay for effects like deductibles, coinsurance and copays. Because plan contents are formalized, only yearly decoration rates vary from provider to provider. It’s also important to note that Medigap programs do n’t cover tradition medicines. A person enrolled in Original Medicare who wants tradition medicine content needs to buy a separate Medicare Part D plan in addition to any Medicare Supplement plan.

Meanwhile, Medicare Advantage programs are only formalized in that they must give the same benefits of Original Medicare, as the plans serve as a direct cover. After this threshold is met, private insurance providers can add any number of benefits and services to a plan — tradition medicines, dental care, vision care and further to make them more comprehensive( and frequently more precious). Yearly decoration rates for Medicare Advantage plans tend to vary dramatically grounded on position and the list of benefits handed.

How to Choose the Right Medicare Supplement Plan for You

To find the right Medigap plan for you, first ask yourself

• What are my health care needs now and conceivably in the future? Consider your current health status as well as your family history.

• What’s my health care budget now and in the future?

Medicare Supplement Plans Comparison Chart

There are 10 standardized Medigap plans with letter names A throughN. Plans with the same letter must offer the same introductory benefit anyhow of the insurance company furnishing the plan. For illustration, all Medigap Plan A programs give the same benefit, but health insurance company decorations vary grounded on the way they choose to set rates — community- rated, entry age- rated or attained- age- rated.

How to subscribe Up for Medigap Plans

Signing up for a Medigap plan is easy. “ Medicare supplements may be bought through an agent or from the carrier directly, ” says Corujo. Since there’s no periodic open registration period, you may join at any time.

To buy a Medigap policy, it’s stylish to enroll during your Medigap Open Enrollment period, which lasts six months. This period begins the first month you have Medicare Part B and are 65 or aged. You can buy any Medigap policy vended in your state during this time, indeed if you have health problems.

Follow the way below to buy your Medigap plan

• Enroll in Medicare Part A and Part B. This step is needed to buy a Medigap plan. Flash back Medicare and Medigap plans do n’t cover tradition medicines, so you may also want to consider enrolling in a Medicare Advantage plan or a plan that offers medicinecoverage.However, you can not also enroll in a Medigap plan, If you choose a Medicare Advantageplan.However, consider whether a Medigap plan would profit you; if so, drop your Medicare Advantage plan before buying a Medigap plan, If you ’re formerly enrolled in a Medicare Advantage plan.

• Find which insurance companies in your state are certified to vend Medigap plans by visitingMedicare.gov.

• Compare costs between companies. Costs will vary depending on the company, state and other factors, but the content they offer will be the same.

• elect a Medigap plan that works stylish for you and buy your policy.

When Is the Stylish Time to subscribe Up for Medicare Supplement?

The stylish time to enroll in a Medicare Supplement plan is during your original Medigap Open Enrollment Period, the six- month window that begins on the first day of the month in which you ’re both 65 or aged and enrolled in Medicare Part B. This registration period is the only timeframe in which insurance companies can not deny you a policy grounded on your health status or any medical condition.

trying to enroll in a Medicare Supplement plan at any other time outside this registration period could affect in penalty freights or denial of content.