HOW TO APPLY FOR MEDICARE IN 2022

The US compensates and safeguards resigned laborers through Federal retirement aide and Government health care programs. These frameworks are paid for all through your profession and supply a well being net for senior residents. However, in the event that you’re approaching retirement age, you might be worried about pursuing Federal medical care.

What is it that you really want to do to be prepared? Also, what could you at any point anticipate in the meantime?

Fortunately, there are a lot of assets to direct you through this occasionally muddled process. Follow these moves toward guarantee your Federal health insurance application goes through without a hitch and gives you the full inclusion you want.

Grasping the Essentials of Government medical care

Unique Federal medical care is a protection intend to facilitate the medical services trouble as you become older. It doesn’t, in any case, pay for each clinical expense you might cause.

Understanding how Government medical care plans work is fundamental to exploring specialist visits post-retirement. Fortunately, quite a bit of this ought to sound recognizable in the event that you have earlier health care coverage experience.

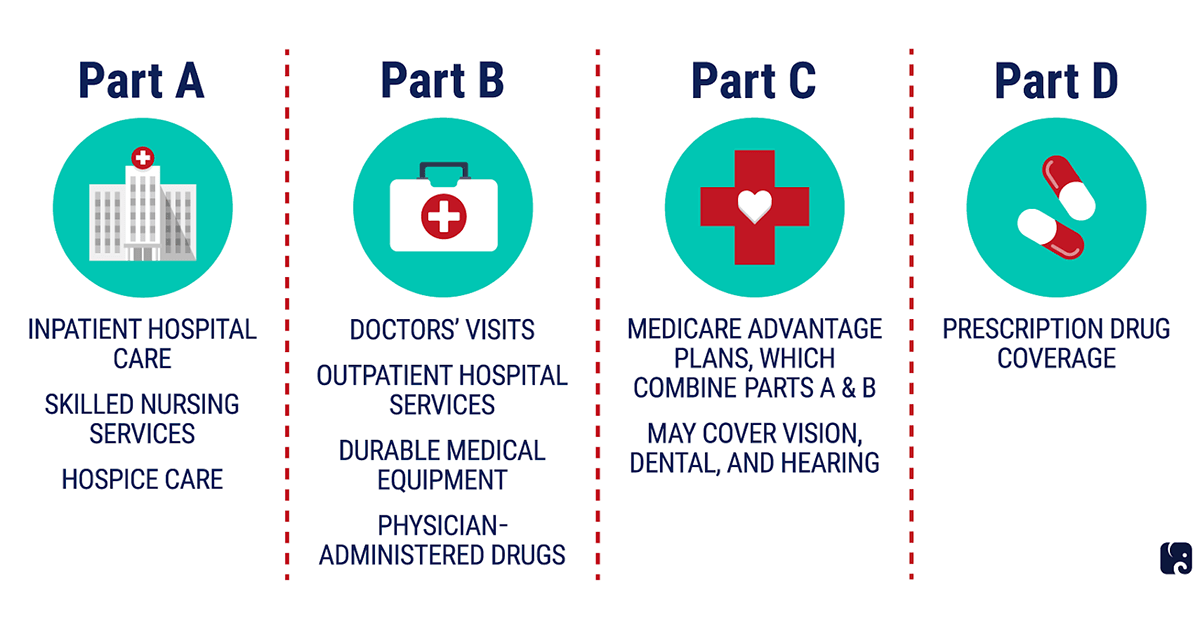

Unique Federal health care is separated into two parts: Section An and Part B. Each handles various parts of clinical consideration and accompanies various advantages. There are a couple of different choices you can browse too, like Part D, Medigap, or Federal health care Benefit.

Government medical care Section A

Federal health care Section An is the “default” side of Government medical care. A great many people consequently sign up for it when they apply for Government backed retirement and don’t have to pay charges. Section A covers costs like medical clinic stays, nursing offices, in-home consideration, and comparative therapies.

Section A safeguards senior residents in the event that they need delayed clinical consideration. If, for instance, you acknowledge extremely durable or brief residency in a nursing home, Section A can assist with taking care of month to month costs.

Federal medical insurance Part B

In the interim, Part B is discretionary yet normally packaged with Section A.

This plan normally needs a little month to month premium. Part B covers clinical benefits that don’t need remaining at an emergency clinic or care office. Specialist’s visits, tests, and emergency vehicle ride the entire fall under this arrangement.

It’s smart to pursue Part B close by Section A. Ordinary patients possibly forego Part B in the event that they have medical coverage through different means, like a functioning companion. When other protection inclusion slips, Part B turns into a fundamental piece of your Government health care plan.

Federal health care Part D

At long last, Federal health insurance Part D covers physician recommended drug costs. In the event that you have an ailment that is probably going to require broad prescription, Part D can prompt critical reserve funds. In any case, similar to Part B, this plan will cost somewhat more in month to month charges, and confidential guarantors oversee it.

Taking into account Other Federal health insurance Choices

Moreover, you might pursue a Federal medical care Plan beyond the First Government medical care. Federal health care Benefit plans pack Government medical care benefits through a confidential safety net provider, ordinarily with additional advantages. They frequently offer Parts A, B, and D together. Advantage plans should meet or surpass the minor necessities of Unique Government medical care.

One of the huge masters of Federal health care Benefit plans is that generally offer a personal greatest. Where Unique Federal medical care doesn’t cover the aggregate sum you can spend on medical services, a Government medical care Benefit plan puts a hard cutoff on your spending every year. This can give resigned families inner serenity and make planning more straightforward.

One final decision to consider is a Medigap plan. These plans, additionally through confidential protection, support holes in Federal medical insurance inclusion. On the off chance that, for instance, you really want a method that Government health care considers superfluous, a Medigap plan might take care of you.

Fitting the bill for Government medical care

All through their vocation, laborers pay Government managed retirement and Federal health care duties to subsidize the two frameworks. Then, at 65 years old, they partake in those advantages themselves. Expecting you meet the base commitments, pursuing Government medical care is somewhat straightforward. There are likewise a couple of alternate ways of applying early or on the other hand on the off chance that you don’t qualify through made good on charges.

Qualifying by Age

You can pursue Government health care three months prior to turning 65. Your enlistment period then, at that point, broadens an additional three months a while later. This seven-month window is pivotal. In the event that you miss it, you might be compelled to sit tight for the overall enlistment time frame and suffer consequences, coming about in higher charges.

The vast majority pursue Federal medical insurance while signing up for Government managed retirement. As a feature of your application, you can pick the choice about whether to sign up for Parts B or D or to utilize a confidential arrangement. Albeit quite a bit of this can be changed later, you ought to have an overall thought of your drawn out objectives prior to starting the cycle.

Qualifying Through Inability

At times, laborers meet all requirements for Government health care before age 65. This regularly occurs through inability. In the event that a specialist qualifies and can never again work, the person might look for inclusion. Extremely durable kidney disappointment, for instance, is a condition that naturally fits the bill for Federal health insurance help.

Qualifying Through the Railroad Retirement Board

Railroad laborers follow an alternate retirement way than the typical specialist. They are excluded from Government managed retirement and get benefits through the Railroad Retirement Board. Regardless, resigned rail line laborers might in any case be qualified for Government medical care. Railroad retirement benefits normally auto-enlist their laborers in Government health care, very much like Government backed retirement.

Qualifying Without Meeting Federal medical insurance Prerequisites

You may as yet get to these advantages on the off chance that you didn’t do whatever is necessary fit the bill for Federal retirement aide or Government health care completely. You will, be that as it may, need to pay extra expenses every month. The sum you pay is chosen by pay and the quantity of government backed retirement credits you’ve acquired. When you arrive at the age of 65, you can apply for benefits like some other retiree.

Pursuing Government medical care

At the point when your enlistment period at long last shows up, you ought to have the option to apply for Federal medical care benefits without any problem. The cycle is smoothed out however much as could be expected for individuals of any age, capacities, and technical knowledge. How you join relies upon your circumstance and your decision of Government medical care plan.

Applying Through Government backed retirement

As referenced before, the typical laborer pursues Government managed retirement and Federal medical care all the while. This application is given on the web, by telephone, or via mail through the Government managed retirement Organization. Government managed retirement candidates are signed up for Parts An and B as a matter of course; to bar Part B or utilize a confidential protection plan, you’ll have to express so during the application.

Applying for Government medical care Alone

In specific conditions, you might need to pursue Government medical care without guaranteeing Federal retirement aide benefits. The Federal health care office makes this conceivable through a comparable application process. You can bring in or finish up a structure on the Federal medical care site to begin.

When you’ve effectively enrolled for your advantages, you’ll get a Federal medical care card via the post office. This has generally your fundamental arrangement data, so look out for it. In the event that you lose this card or it becomes harmed, you can constantly apply for a substitution on the web or by telephone.

Finding support with Federal health care Inclusion

Federal medical care is intended to be basically as straightforward and straightforward as could really be expected, however picking the right well being inclusion for your retirement ought to never be messed with. For instance, you might address whether your ongoing doctor acknowledges another arrangement.

At the point when you feel a little skeptical or concerns with respect to Federal health insurance, don’t depend on your most realistic estimation. Pose inquiries with experts who figure out the framework and its numerous complexities. Contact a Government medical care delegate or master today to find out about your arrangement choices and pursue the best decision for your future well being and prosperity.

The Site cannot and does not contain fitness, legal, medical/health advice. The fitness, legal, medical/health information is provided for general informational and educational purposes only and is not a substitute for professional advice. Accordingly, before taking any actions based upon such information, we encourage you to consult with the appropriate professionals. We do not provide any kind of fitness, legal, medical/health advice. THE USE OR RELIANCE OF ANY INFORMATION CONTAINED ON THE SITE IS SOLELY AT YOUR OWN RISK.

DISCLAIMER